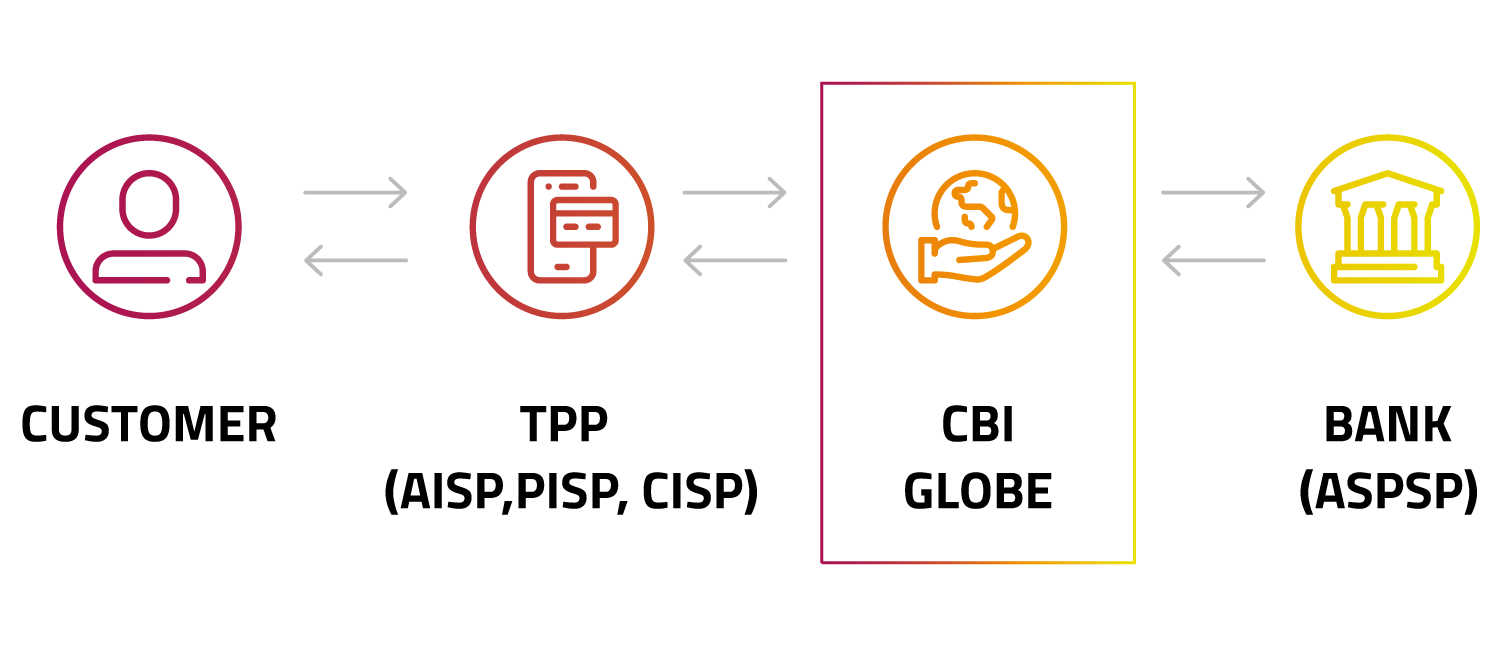

HOW DOES IT WORK

The CBI Globe platform support the compliance obbligations for the Bank resulting from the PSD2, simplifying its implementation.

Because the PSD2 is much more than exposing APIs: it requires processes, security infrastructures, rules and very complex safeguards for Banks if faced individually.

CBI Globe enables Banks to expose, in line with the directive, more than 20 APIs to Third Parties and to enable the offer of services to the new players envisaged by the PSD2.

Furthermore, the solution will enable to offer a wide range of value-added services, both cooperative and competitive, to maximize the business opportunities offered by the new Open Banking paradigm.

COLLABORATIVE VAS

We analyze new service proposals made by the involved actors and they develop them at a cooperative level. Value-added services will be offered through the platform on a “shared” access basis.

COMPETITVE VAS

We will enable the adhering parties to develop value-added solutions to offer competitively to their customers via reserved partitions of the platform.

FORMS

OF THE SOLUTION

API PORTAL AND SANDBOX

API interface Front-End for the exposition of services, with TTP test environment.

TPP MANAGEMENT

Third Parties onboarding, "hand-shake" and verification of certificates through alignment with Competent Authority.

CONSENT MANAGEMENT

User consent collection, verification of validity and management of the entire "life cycle" (creation and withdrawal of consent).

FRAUD MANAGEMENT

Evaluation of the transactions Fraud Rate based on "system" data, to complement the Bank's internal risk analyzes.

SCA - STRONG CUSTOMER AUTHENTICATION

Verification of the "SCA base" exemption cases and orchestration of the SCA solutions of the individual Banks.

HELP DESK & DISPUTE

Availability of transactions data, management of the contacts with Banks and Third Parties and End-to-End disputes management.

VAS: CUSTOMIZATIONS AND EVOLUTIONS

Enabler of value-added services, developed both at a cooperative level (defined collegially), and at a competitive level (defined by the individual Banks).